Not known Facts About Paul B Insurance

Wiki Article

How Paul B Insurance can Save You Time, Stress, and Money.

Table of ContentsThe 2-Minute Rule for Paul B InsuranceMore About Paul B InsuranceThe Best Strategy To Use For Paul B InsuranceThe Ultimate Guide To Paul B InsuranceIndicators on Paul B Insurance You Need To KnowPaul B Insurance Can Be Fun For Anyone

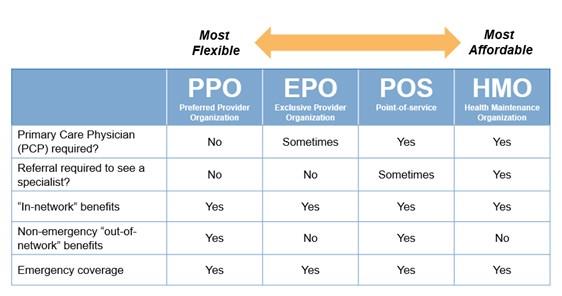

Associated Topics One factor insurance coverage problems can be so confounding is that the health care market is frequently changing and also the insurance coverage intends used by insurance firms are hard to categorize. In various other words, the lines in between HMOs, PPOs, POSs and also various other sorts of protection are often blurry. Still, recognizing the makeup of numerous plan types will certainly be helpful in evaluating your alternatives.

Once the insurance deductible amount is gotten to, additional health and wellness expenses are covered according to the arrangements of the medical insurance policy. For instance, an employee might after that be liable for 10% of the prices for care gotten from a PPO network company. Deposits made to an HSA are tax-free to the employer and also staff member, as well as money not invested at the end of the year might be rolled over to spend for future medical expenses.

The Buzz on Paul B Insurance

(Employer contributions must be the same for all employees.) Employees would certainly be accountable for the first $5,000 in medical prices, however they would each have $3,000 in their individual HSA to spend for medical costs (and would have a lot more if they, also, added to the HSA). If workers or their families tire their $3,000 HSA part, they would certainly pay the next $2,000 expense, whereupon the insurance coverage policy would certainly start to pay.There is no limitation on the quantity of money a company can contribute to staff member accounts, however, the accounts might not be funded with staff member wage deferrals under a snack bar strategy. Additionally, companies are not allowed to reimburse any kind of part of the equilibrium to workers.

Do you understand when one of the most terrific time of the year is? No, it's not Xmas. We're talking regarding open registration season, baby! That's! The enchanting season when you reach contrast health and wellness insurance prepares to see which one is appropriate for you! Okay, you got us.

Indicators on Paul B Insurance You Should Know

However when it's time to select, it is essential to understand what each strategy covers, just how much it sets you back, and also where you can utilize it, right? This things can feel challenging, but it's much easier than it seems. We placed together some practical knowing steps to aid you feel positive concerning your alternatives.(See what we did there?) Emergency situation care is often the exception to the regulation. These strategies are one of the most popular for individuals that obtain their medical insurance with work, with 47% of covered employees signed up in a PPO.2 Pro: The Majority Of PPOs have a respectable selection of carriers to select from in your area.

Disadvantage: Higher costs make PPOs more expensive than various other types of plans like HMOs. A health and wellness maintenance company is a medical insurance strategy that normally just covers care from medical professionals that benefit More Help (or contract with) that specific strategy.3 So unless there's an emergency, your plan will not pay for out-of-network care.

The Buzz on Paul B Insurance

More like Michael Phelps. It's great to recognize that strategies in every group give some kinds of free preventive care, and some offer free or discounted healthcare services prior to you fulfill your deductible.Bronze plans have the least expensive month-to-month costs however the greatest out-of-pocket prices. As you function your means up via the Silver, Gold and also Platinum groups, you pay extra in costs, however less in deductibles and coinsurance. But as we pointed out before, the extra costs in the Silver classification can be decreased if you get the cost-sharing decreases.

Unknown Facts About Paul B Insurance

When selecting your medical insurance plan, don't ignore health care cost-sharing programs. These job quite much like the other medical insurance programs we defined currently, however practically they're not a type of insurance coverage. Enable us to describe. Health cost-sharing programs still have month-to-month costs you pay as well as defined coverage terms.

If you're attempting the do it yourself course as well as have any type of remaining questions concerning health and wellness insurance policy plans, the specialists are the ones to ask. As well as they'll do greater than just address your questionsthey'll also find you the very best cost! Or perhaps you would certainly such as a method to combine obtaining terrific health care protection with the chance to assist others in a time of requirement.

Not known Incorrect Statements About Paul B Insurance

CHM aids families share healthcare expenses like clinical examinations, maternity, hospitalization as well as surgical procedure. And also, they're a Ramsey, Trusted partner, so you understand they'll cover the clinical expenses they're intended to and honor your coverage.Key Concern 2 One of things healthcare reform has carried out in the U.S. (under the Affordable Care Act) is to introduce more standardization to insurance coverage strategy advantages. Before such standardization, the my response benefits used different significantly from plan to plan. For example, some plans covered prescriptions, others did not.

Report this wiki page